Among numerous policy suggestions floating around ahead of the Budget is a potential doubling of council tax for those in Council Tax bands G and H – the highest bands in England, representing about 4% of all properties.

With the potential to raise over £4.2 billion per annum by the end of the decade, according to the IFS, one can see the appeal of such a reform at a time when the public purse is under enormous pressure. But can the residents in these homes actually afford to pay a Council Tax bill that’s twice as high? And is there likely to be much in the way of political fallout?

One source of data which can answer these questions is the Family Resources Survey (FRS) – a detailed dataset of household finances and demographics. Critically, the FRS contains information on a household’s Council Tax band. And with a sample of close to 12,000 households across England, including about 500 band G and H residents, it can shed light on who lives in these homes.

New Public First analysis of the FRS provides a number of key insights. In our view, a doubling of bands G and H is an unsatisfactory fudge that avoids more substantial reforms to Council Tax for longer. With only 4% of households affected, the political risks are likely to be seen as smaller than broader reforms to the system. However, with residents skewing older and many not being rich in income terms, there is a real risk that this will be seen as a “Granny Tax” – something which has historically proven politically difficult.

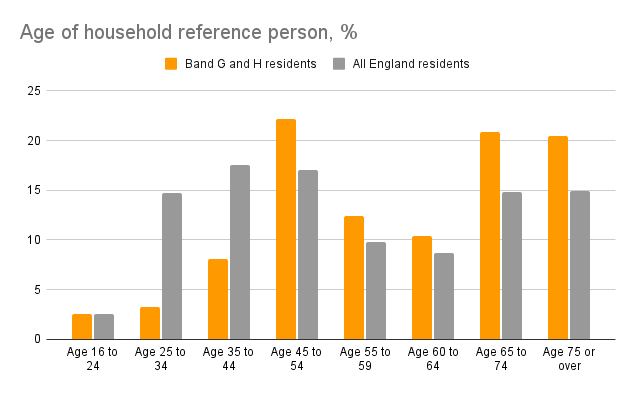

Band G and H residents skew old

Our analysis suggests over two-fifths (41%) of band G and H households are pensioner households. This compares with less than 30% across the whole population in England. One potential framing of this Council Tax reform is therefore that it would be going after older households who, while living in high-value homes, may be “asset rich but cash poor” – not having the income to deal with a significantly higher Council Tax bill.

This compares with less than 30% across the whole population in England. One potential framing of this Council Tax reform is therefore that it would be going after older households who, while living in high-value homes, may be “asset rich but cash poor” – not having the income to deal with a significantly higher Council Tax bill.

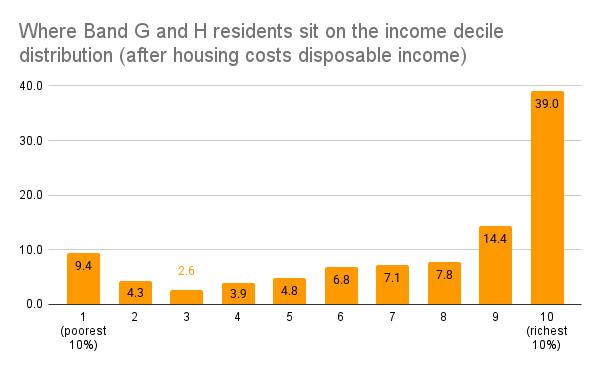

G and H residents are an affluent bunch on average, though a quarter are in the bottom half of the income distribution.

Our analysis suggests that the median household income (after housing costs) for band G and H residents is £62,400 per year. This is close to double the England-wide median of £32,500. Undoubtedly, this is a relatively affluent group on average, albeit perhaps not so affluent as to be described as “rich”.

Further, not all of band G and H residents are affluent. According to our analysis, roughly a quarter are actually in the bottom half of the after-housing-costs national income distribution. Given this, arguments about the “asset rich but cash poor” appear to have legs.

Council Tax is a not-insignificant expense for G and H residents

The Family Resources Survey data relate to 2023-24, and show the median G and H resident paid £3,500 per year in Council Tax. This figure will be higher now.

As a share of disposable income, Council Tax for bands G and H stands at 5.1% – it is therefore a significant financial cost for this group. For about one in 15 band G and H residents (6.4% of residents) Council Tax accounts for over 10% of their disposable income.

If band G and H Council Tax doubled, almost a fifth (18%) of residents would see the tax gobbling up 10% of their disposable income – about 160,000 households.

What’s the political risk here?

Any reforms to Council Tax are fraught with risks, hence the persistence of the current system of tax bands which are based on home values in the early 1990s. This is widely known to be problematic – for example, meaning that homes in London and the South East of England are relatively undertaxed given the substantial house price growth seen subsequently in these parts of the country. Conversely, households in the North of England may be relatively overtaxed.

A doubling of bands G and H ducks out of more substantial reforms to Council Tax. The Government might see this as an easy way out given only 4% of properties are affected. However, as we have seen time and time again, the politics of tax increases for the elderly asset rich but cash poor are challenging. This could become the next “Granny Tax”.